President Donald Trump confirmed late Monday that his administration will enact tariffs on Canada and Mexico at midnight tonight.

“They’re all set. They go into impact tomorrow,” Trump instructed reporters on the White Home. The New York Instances explains, “The tariffs will add a 25% charge on all Mexican and Canadian exports coming throughout these borders and an extra 10% for Chinese language items.”

Trump has not set an expiration date on the measure, and negotiators from all concerned international locations are reportedly assembly to debate elevate the levies.

New Automotive Costs Will Rise

Tariffs will probably elevate the worth of nearly each automobile offered in america, new and used, however could not present up on window stickers in a single day.

The Washington Put up explains, “Greater than half of products categorized as automotive automobiles, elements, and engines come from Canada and Mexico.” Automakers headquartered within the U.S., Europe, and Asia all personal factories in Mexico or Canada and convey completed vehicles throughout the border — about 3.6 million final 12 months, in response to S&P World Mobility. These will all see their sticker costs inflate by 25% or extra.

Nonetheless, even vehicles constructed within the U.S. use many elements from Canada and Mexico. There are not any purely American vehicles. Trade publication Automotive Information explains, “Fashionable North American automotive provide chains are extraordinarily complicated and had been constructed with minimal commerce obstacles in thoughts. Components can cross the border a number of instances earlier than a car is accomplished.”

A component will see its value improve each time it crosses a border. Which means many vehicles will see their costs rise by greater than 25%. Mexico and Canada could retaliate with matching tariffs, doubling the impression.

Two current analyses discovered that the common automobile’s value might rise by a minimum of $3,000. Yet another current and arguably extra thorough evaluation concluded that the entire could possibly be a lot increased — as excessive as $9,000 for a midsize SUV and over $10,000 for a full-size truck.

Used Automotive Costs Will Rise, Too

Used automobile costs will probably rise in response as would-be new automobile buyers head to used automobile heaps looking for one thing they will afford. The value of the common used automobile fell barely final month, however sellers warned that they had been barely quick on stock firstly of tax season. People sometimes head to used automobile heaps in heavier numbers as soon as tax returns seem in financial institution accounts.

Restore, Insurance coverage Prices Will Spike

Most automobile elements utilized in auto repairs are imported, usually from Canada or Mexico. That can inflate the price of automobile repairs.

With it, insurance coverage prices will rise. A current evaluation from insurance coverage pricing service Insurify predicted that the tariffs will push automobile insurance coverage charges up “8% by the tip of 2025, from $2,313 to $2,502.”

However Sticker Costs Received’t Rise In a single day

The tariffs will apply as vehicles and elements cross the border. Nonetheless, the automobiles on vendor heaps are already right here and gained’t see the levy added to their costs.

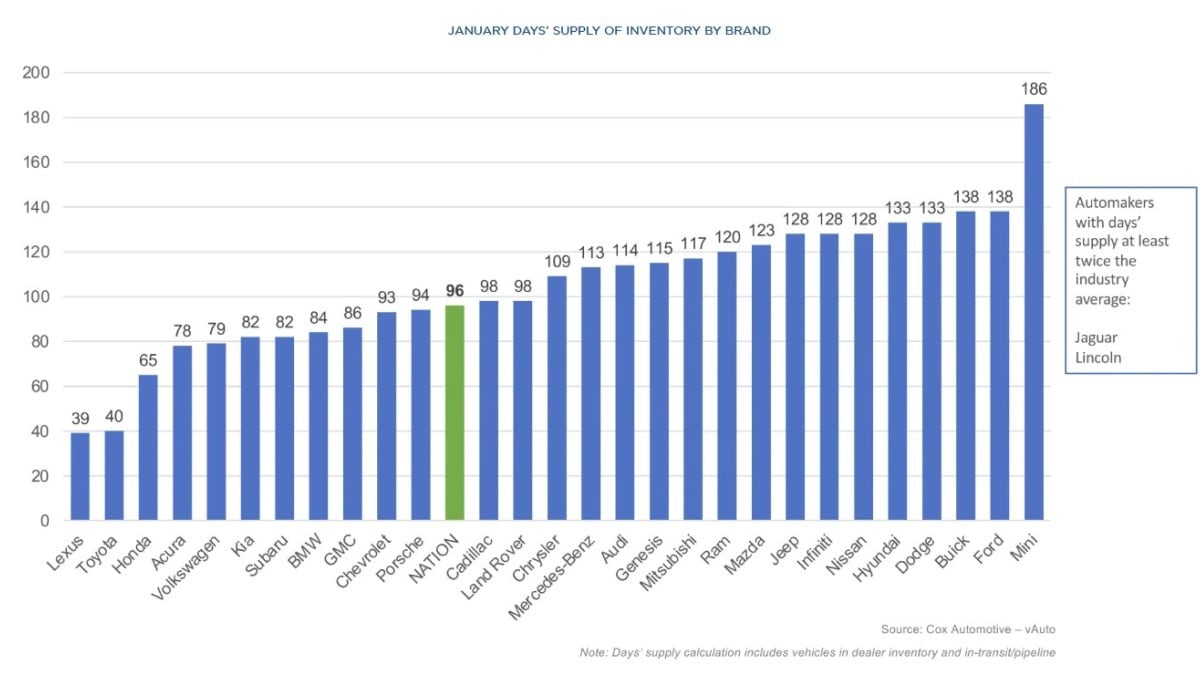

Automakers intention to maintain a couple of 75-day provide of used vehicles — 60 days on vendor heaps and one other 15 in transit — always. Some are nicely wanting that determine this 12 months. However a number of are over it.

Customers are more likely to see tariff-impacted costs first at Lexus and Toyota, every with near a 40-day provide in the intervening time. Different manufacturers, together with Ford, Lincoln, Buick, Jeep, Ram, and Mercedes-Benz, have over 100-day provide in inventory.

Some reportedly moved further vehicles into the nation forward of the tariff deadline to have a backstop of vehicles at pre-tariff costs out there for buy.

Customers might see costs at these heaps maintain regular for weeks as stock drains down. They’ll rise as the businesses are pressured to import extra vehicles or resolve to pause manufacturing to attend for political developments.

Customers who can transfer shortly would possibly nonetheless discover pre-tariff costs straightforward to search out.

Corporations Can’t Change Provide Strains Shortly

Trump has mused that automakers and elements suppliers ought to transfer manufacturing to the U.S. to get across the tariffs. That’s difficult, nonetheless.

Automotive Information explains, “Most firms have few choices to shift manufacturing or elements sourcing to cut back tariff publicity due to yearslong product cycles and large funding necessities.”

The design cycle for a brand new automobile can take 10 years. Trump, in his second time period, will likely be in workplace lower than 4. Automakers make few selections with a horizon as quick as 4 years.

As an alternative, Automotive Information explains, “Automakers might additionally resolve to halt car manufacturing, particularly in the event that they suppose the tariffs could possibly be lifted shortly.” Some factories might fall silent whereas negotiations geared toward lifting the tariffs drag on.

Anderson Financial Group, a consultancy specializing within the auto business, predicted final week that the tariffs might impression the business greater than final 12 months’s record-breaking United Auto Employees union strike.

“In the meantime, many automakers and suppliers have held off on making main funding and manufacturing selections till they get a way of the brand new commerce surroundings,” Automotive Information studies. Final week, Ford instructed suppliers it’d delay the launch of its subsequent F-150, America’s best-selling car, preserving the present mannequin on the highway longer whereas it waits for readability.

“Each automaker is in danger in a roundabout way right here and, extra importantly, has a crucial provide chain already going through inflation, labor unrest, and affordability challenges,” says Cox Automotive Government Analyst Erin Keating. “Tariffs throughout North America gained’t simply impression the ‘large guys,’ as a result of there are numerous small companies in all three international locations which have labored collectively for many years to provide among the market’s most inexpensive automobiles.”

Cox Automotive owns Kelley Blue E-book.

Different Tariffs Scheduled

Even when negotiations make these tariffs short-lived, automakers face a minimum of three different doable levies. Trump has additionally promised new tariffs on aluminum and metal — the first supplies utilized in car manufacturing. These might take impact March 12.

He has threatened tariffs particular to the auto business, as excessive as 25% on all imported vehicles however designed to “go considerably increased over the course of a 12 months.” These might start on April 2.

He has threatened “reciprocal tariffs” on American commerce companions, that means the U.S. would match any tariff a rustic locations on U.S. items. These don’t have any particular efficient date, as Trump requested White Home officers to review the difficulty and make suggestions quickly.